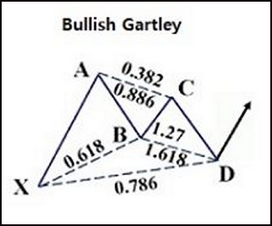

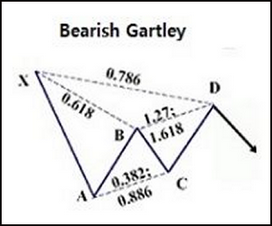

The Gartley pattern was outlined by H.M. Gartley in his book Profits in the Stock Market, published in 1935. Although the pattern is named "The Gartley," the book did not discuss specific Fibonacci retracements! It was not until "The Harmonic Trader" was released that the specific retracements of the B point at a 0.618 and the D point at a 0.786 were assigned to the pattern. There are others who have assigned Fibonacci retracements to this framework. However, they use a variety of Fibonacci numbers at the B and D points.

Despite these variations, the Fibonacci retracements that yield the most reliable reversals are the 0.618 at the B point and the 0.786 at the D point. Furthermore, the pattern should possess a distinct AB=CD pattern that converges in the same area as the 0.786 XA retracement and the BC projection (either 1.27 or 1.618). The most critical aspect of the Gartley is the B point retracement, which must be at a 0.618 of the XA leg.

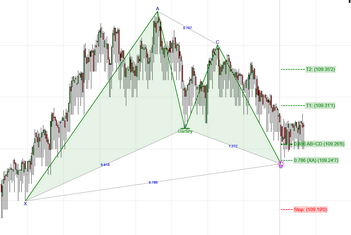

The Gartley pattern can be toggled on or off by checking/unchecking the Show Gartley? checkbox in the parameters dialog.

Here are some example Gartley patterns.

The Terminal Bar is the price bar that reaches the minimum pattern completion requirements and will always be identified by the ☼ symbol. You can adjust the size via the Terminal Bar Font Size option in Settings.

See Also: