Harmonic Strength Index

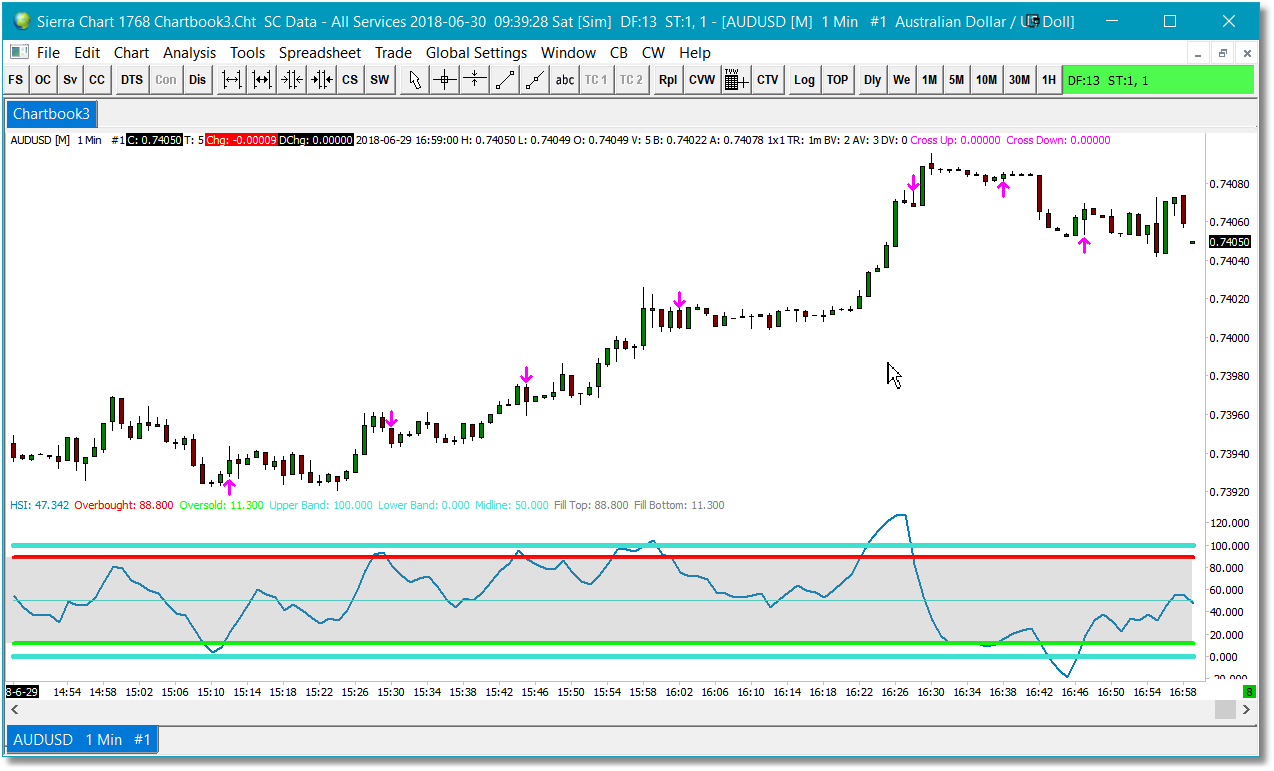

The Harmonic Strength Index (HSI) is the primary indicator for accompanying harmonic pattern identification and it is designed to replace RSI for harmonic traders.

HSI is used to confirm and identify harmonic patterns as well as to time entries within the PRZ. HSI is unique in that it oscillates at a far more active frequency than RSI while still managing to avoid extended stays above overbought/oversold or repeated false signals in close succession. Instead, HSI takes the first few hundred bars of the chart to adapt is oscillation frequency to the behavior of the instrument and then continues to update its response as time passes. The result is informative, decisive signals throughout varying levels of market volatility.

There is a companion indicator called HSI Arrows that can be loaded into the price pane. HSI Arrows will display an up-arrow below each bar where HSI crosses up through the lower threshold and a down-arrow above each bar where HSI crosses down through the upper threshold.

To load the Harmonic Strength Index into a chart:

•Select the Analysis option off the main menu, then select the Studies option from the drop-down menu.

•Click on the Add Custom Study button in the Chart Studies dialog.

•Select HSI and/or HSI Arrows from the list of available studies under the Harmonic Pattern Collection section in the Add Study dialog.

•Click on the Add button and the selected study will be added into the Studies to Graph section of the Chart Studies dialog.

•Click on the Settings button if you wish to adjust the settings, otherwise click on the Ok button and the indicator will be added to your chart.

•If you do select the Settings option, click on the Subgraphs tab in the Study Settings dialog to access the cosmetic parameters.

See Also: