Harmonic Strength Index

The Harmonic Strength Index (HSI) is the primary indicator for accompanying harmonic pattern identification and it is designed to replace RSI for harmonic traders.

HSI is used to confirm and identify harmonic patterns as well as to time entries within the PRZ. HSI is unique in that it oscillates at a far more active frequency than RSI while still managing to avoid extended stays above overbought/oversold or repeated false signals in close succession. Instead, HSI takes the first few hundred bars of the chart to adapt is oscillation frequency to the behavior of the instrument and then continues to update its response as time passes. The result is informative, decisive signals throughout varying levels of market volatility.

There is a companion indicator called HSI Arrows that can be loaded into the price pane. HSI Arrows will display an up-arrow below each bar where HSI crosses up through the lower threshold and a down-arrow above each bar where HSI crosses down through the upper threshold.

|

Note: The Harmonic Strength Index can also be used in the Market Analyzer. The HSI Arrows indicator is not Market Analyzer-compatible. Please note that the HSI calculation is heavily dependant upon a certain amount of volatility being present in the price action in order to kick-start the calculation. There will be times when the volatility requirements are not met in the range of bars currently present in the chart, and the HSI indicator will flatline at a level of 50. |

To load the Harmonic Strength Index into a chart:

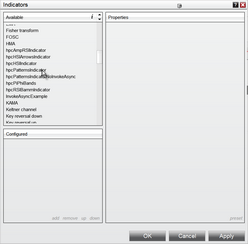

•Right-click in your chart and select the Indicators option from the pop-up menu.

•The Indicators dialog will be displayed. Scroll down the list under the Available column until you find the hpc indicators.

•Double-click on the hpcHSIIndicator in that list and it will be added into the Configured section of the dialog. You can now adjust any parameters in the Properties section. Click on the OK button when done and the indicator will be loaded into your chart.

See Also: