Both the Bat pattern and the Alternate Bat Pattern are supported by the Harmonic Patterns Indicator.

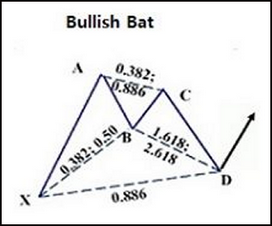

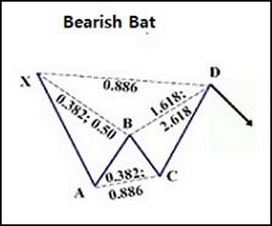

The Bat pattern is a precise harmonic pattern discovered by Scott Carney in 2001. The pattern incorporates the 0.886XA retracement, as the defining element in the Potential Reversal Zone (PRZ). The B point retracement must be less than a 0.618, preferably a 0.50 or 0.382 of the XA leg. The Bat utilizes a minimum 1.618BC projection. In addition, the AB=CD pattern within the Bat is extended and usually requires a 1.27AB=CD calculation. It is an incredibly accurate pattern and requires a smaller stop loss than most patterns.

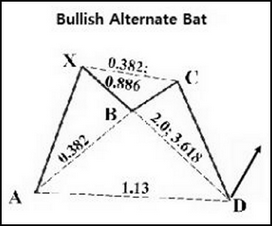

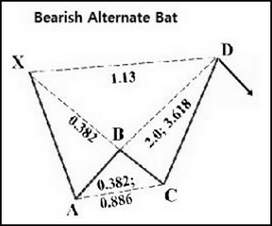

The Alternate Bat pattern is a precise harmonic pattern discovered by Scott Carney in 2003. The pattern incorporates the 1.13XA retracement, as the defining element in the Potential Reversal Zone (PRZ). The B point retracement must be a 0.382 retracement or less of the XA leg. The Alternate Bat utilizes a minimum 2.0BC projection. In addition, the AB=CD pattern within the Alternate Bat is always extended and usually requires a 1.618AB=CD calculation. The Alternate Bat is an incredibly accurate pattern that works exceptionally well.

The Bat pattern can be toggled on or off by checking/unchecking the Show Bat? checkbox in the parameters dialog.

Here are some example Bat patterns.

The Terminal Bar is the price bar that reaches the minimum pattern completion requirements and will always be identified by the ☼ symbol. You can adjust the size via the Terminal Bar Font Size option in Settings.

See Also: