Based on the work of Nicolas Darvas, Darvas Box is essentially a support/resistance indicator and a trading methodology rolled into one. It is implemented as an overlay in Technician. While the indicator will run on any bar interval it is best used on higher intervals (i.e., weekly/monthly) with strong securities in a strong trend. The logic behind the construction of the Darvas Box is somewhat complex but the usage is fairly straightforward. Once you have a closed box (a blue box assuming the default settings) you wait for a close (or a high) above the box on higher volume for a buy signal or a close (or a low) below the box on higher volume for a sell signal. The stop would generally be set just past the other side of the box. As new boxes form while you are in a trade you would add to the trade on new breakouts and the stop would also be trailed to the most recent box. When used strictly as an indicator, the Darvas Box is an excellent mechanism to identify trading ranges on all bar intervals.

Darvas Box running on a weekly AL chart.

A full discussion of Darvas theory as well as the various trading methodologies that have been formulated is beyond the scope of this document. Needless to say, there are numerous websites available that discuss Darvas theory in great detail and provide insights into successfully using Darvas in today's markets.

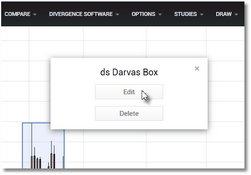

To remove the indicator from the chart, or to edit any of the settings, move your cursor over the top of any of the plotted Darvas boxes. A small dialog will appear indicating that you should right-click to manage. Right-click in your chart and the Edit/Delete dialog will now be displayed:

Click Edit to access the parameter menu or

click Delete to remove the overlay.

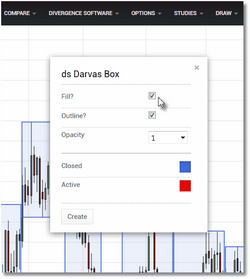

Click on the Edit button and the Darvas Box parameters dialog will be displayed. See the Settings section for a complete description of all of the available parameters.

Make your settings changes and then click on

the Create button to apply them to the overlay.

See Also: